Main Heading Subtopics

H1: Verified LC through MT710: How to Safe Payment in Significant-Risk Marketplaces By using a Next Bank Promise -

H2: Introduction to Confirmed Letters of Credit rating (LCs) - Great importance in World wide Trade

- Overview of Payment Risks in Unstable Areas

H2: Exactly what is a Verified LC? - Essential Definition

- The way it Differs from an Unconfirmed LC

- Benefits towards the Exporter

H2: The Part in the MT710 in Verified LCs - What's MT710?

- SWIFT Concept Structure

- Crucial Fields That Reveal Confirmation

H2: How a Confirmed LC by way of MT710 Functions - Involvement of Issuing and Confirming Banking companies

- Method Movement from Consumer to Exporter

- Case in point Timeline

H2: When Do you have to Make use of a Verified LC? - Transactions with Superior Political or Economic Risk

- New Consumer Associations

- Discounts Involving Unstable Currencies

H2: Advantages of Making use of MT710 for Affirmation - Improved Payment Stability

- Improved Dollars Movement Predictability

- Creditworthiness of Community Confirming Bank

H2: Essential Variations: MT700 vs MT710 in LC Processing - Which Concept Does What?

- When MT710 Is Made use of Above MT700

- Advising vs Confirming Tasks

H2: Lawful Framework and UCP 600 Suggestions - Article content on LC Confirmation

- Rights and Duties of Confirming Lender

- ICC’s Job in Trade Security

H2: Methods to Protected a Verified LC by using MT710 - Buyer-Initiated LC Request

- Confirmation Request by Exporter

- Bank-to-Bank Negotiation and Last Issuance

H2: Actual-Earth Use Circumstance: Verified LC inside of a High-Danger Market place - Exporter from EU to your Sanction-Vulnerable Location

- Purpose of Confirming Lender in Guaranteeing Payment

- How the MT710 Aided

H2: Pitfalls That a Confirmed LC Will help Mitigate - Issuing Financial institution Default

- Political Instability

- Regulatory Freezes and Sanctions

H2: Cost of Using a Verified LC - Affirmation Costs

- Prospective Hidden Charges

- Negotiating Costs Into your Gross sales Deal

H2: Usually Asked Questions (FAQs) - What’s the distinction between MT710 and MT700?

- Who selects the confirming financial institution?

- Can confirmation be revoked?

- Is confirmation well suited for each individual place?

- Let's say the confirming bank fails?

- How briskly is payment below MT710?

H2: Summary - Recap of Why MT710 is Critical for Risky Marketplaces

- Last Tips for Exporters and Traders

Now I’ll start off composing the long-sort Web optimization report utilizing the construction higher than.

Confirmed LC by using MT710: The way to Secure Payment in Substantial-Risk Markets Which has a Second Financial institution Guarantee

Introduction to Confirmed Letters of Credit rating (LCs)

In today’s unstable world trade surroundings, exporting to significant-danger markets is often lucrative—but risky. Payment delays, currency controls, financial institution failures, and political instability are serious threats. The most responsible tools to counter these hazards is often a Verified Letter of Credit history (LC).

A verified LC ensures that even though the international purchaser’s financial institution defaults or delays, a 2nd financial institution—normally located in the exporter’s region—ensures the payment. When structured throughout the MT710 SWIFT concept, this fiscal basic safety Internet gets more successful and clear.

What on earth is a Verified LC?

A Confirmed Letter of Credit is definitely an irrevocable LC that features yet another payment assurance from a second lender (the confirming financial institution), Together with the issuing financial institution's dedication. This affirmation is especially useful when:

The buyer is from a politically or economically unstable location.

The issuing financial institution’s creditworthiness is questionable.

There’s worry around Intercontinental payment delays.

This additional protection builds exporter self-assurance and guarantees smoother, more rapidly trade website execution.

The Function of the MT710 in Verified LCs

The MT710 is usually a standardized SWIFT concept utilized any time a financial institution is advising a documentary credit that it hasn't issued itself, usually as part of a affirmation arrangement.

In contrast to MT700 (which happens to be used to difficulty the original LC), the MT710 will allow the confirming or advising bank to relay the initial LC content material—from time to time with extra Recommendations, which includes affirmation terms.

Crucial fields during the MT710 contain:

Subject 40F: Method of Documentary Credit rating

Field forty nine: Affirmation instructions

Area 47A: Added disorders (may specify confirmation)

Area 78: Guidelines to your shelling out/negotiating lender

These fields make sure the exporter is familiar with the payment is backed by two different banking companies—greatly reducing risk.

How a Verified LC by using MT710 Is effective

Enable’s split it down in depth:

Customer and exporter agree on verified LC payment conditions.

Customer’s financial institution troubles LC and sends MT700 on the advising financial institution.

Confirming bank gets MT710 from a correspondent bank or via SWIFT with affirmation request.

Confirming lender provides its ensure, notifying the exporter it will pay if conditions are fulfilled.

Exporter ships items, submits files, and receives payment in the confirming bank if compliant.

This set up protects the exporter from delays or defaults via the issuing financial institution or its nation’s limits.

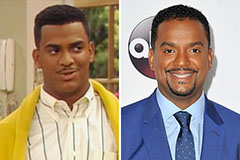

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!